The joint project of Quantitative Finance Research Group and Data Science Lab open seminars has been started in 2019/2020 academic year and was thought of as the place for discussion of the newest research ideas coming from the latest scientific articles. We focus on research from the area of data science, quantitative finance, financial econometrics, machine learning, and risk management.

——————————————————————————-

The schedule of the forthcoming meetings is as follows:

——————————————————————————-

-

- 2026-02-09, Monday, 7.00pm-8.00pm, 65th research seminar, title: “Carry, Convexity and Reliability – Navigating Tail Risk Hedging Dilemmas”

authors: Juliusz Jabłecki, Chris Marais, and Bruno Schwalbach.

abstract:This paper revisits the debate about the merits of tail risk hedging – a strategy designed to produce large payoffs in severe equity drawdowns using negatively correlated, convex instruments such as put options. With the literature split between proponents and detractors, we argue that the discussion about the merits of tail hedges is best framed as a trilemma among carry (the predicable cost of protection), convexity (payoff in adverse states of the world), and reliability (the likelihood protection delivers as and when needed). Building on a second-order Taylor expansion of option mark-to-market P&L, we map these features to option Greeks which in turn allows us to consistently compare different hedge parameterizations across a range of adverse scenarios. Using Monte Carlo experiments and backtests on US equity options data from 1996 through 2025 we show that: (i) longer-dated, deeper OTM puts deliver superior reliability per unit cost, as their convexity decays more slowly with moneyness than carry; (ii) fully and partially delta-hedged overlays limit the dilution of equity market beta while concentrating payoff in the convexity complex (gamma, vega, vanna, volga) and thus tend to be preferable to outright hedges; (iii) even simply devised monetization rules can materially improve outcomes relative to passive buy-and-roll implementations.

additional info: link

published/working paper: will be added soon

presentation: presentation

the recording of the presentation: recording - 2026-01-12, Monday, 6.30pm-8.00pm, 64th research seminar, title: “Infrastructure Capacity, Risk, and Firm Value: Evidence from U.S. Electricity Tightness”

authors: Marcin Kacperczyk, David Licher

abstract:Real-time bottlenecks in non-storable infrastructure-most visibly electricity-can throttle modern production, yet standard models treat capacity as unlimited. We embed proportional rationing of grid supply into multi-sector economy, showing that unexpected scarcity cuts output, employment, and consumption, while the prospect of future capacity expansions mitigates those losses. To test the model’s predictions, we measure U.S. public firms’ exposure to realized electric capacity constraints and future expected capacity tightness. We confirm the model’s predictions using panel regressions with fixed effects and establish causality by exploiting two quasi-natural experiments: the 2021 Texas blackout (a 34 GW supply shock) and subsequent state reforms that raised future expected capacity. Difference-in-differences estimates indicate a drop in short-term profitability and firm value in affected firms. Higher future anticipated capacity leads to higher longer-term employment, capital, and firm value. Investors demand higher expected returns for firms with greater exposure to electric capacity constraints, confirming that infrastructure tightness, either due to excess demand or limited supply, is a priced, macro-critical risk.

additional info: link

published/working paper: SSRN paper

presentation: will be added soon

the recording of the presentation: recording - 2025-12-08, Monday, 5.00pm-7.30pm, 63rd research seminar, title: “Glioma Segmentation Throughout the Treatment Continuum: A Systematic Evaluation of Deep Learning Models for the BraTS 2025 Lighthouse Challenge”

authors: Maciej Kuchciak

abstract:This research investigates automated segmentation of glioma brain tumors in multi-parametric MRI across pre- and post-treatment stages, focusing on clinically realistic, resource constrained settings with a single Tesla T4 GPU. Using the BraTS 2025 Lighthouse dataset (2,872 cases with four MRI sequences and four annotated subregions), we conduct detailedexploratory analysis of class imbalance, volumetric distributions and morphological differences between pre- and post-operative scans, which motivates a full volume crop-and-pad preprocessing pipeline, intensity normalization and label cleaning. Two deep learning architectures, 3D U-Net and SegResNet, are implemented and compared at multiple input resolutions, with hybrid, class weighted loss functions to better capture small but clinically relevant tumor components. Experiments quantify trade-offs between segmentation quality and computational cost, reporting not only Dice based performance but also memory usage, training time and approximate cloud compute expenses. Results show strong performance on pre-treatment data but marked degradation in post-treatment cases, particularly for enhancing core and resection cavity, and link typical failures to specific imaging patterns such as fragmented cavities and treatment related changes. We recommend configurations that balance accuracy and cost for practical deployment and outline directions for improving robustness in post treatment segmentation.

additional info: link

published/working paper: will be added soon

presentation: will be added soon

the recording of the presentation: recording - 2025-12-01, Monday, 6.30pm-8.00pm, 62nd research seminar, title: “A Time-Varying Interpretable Multi-Scale Transformer for Exchange Rate Returns Forecasting and Investment Decision Support“

authors: Dinggao Liu, Robert Ślepaczuk, Zhenpeng Tang

abstract:Accurately forecasting daily exchange rate returns represents a longstanding challenge in international finance, as the exchange rate returns are driven by a multitude of correlated market factors and exhibit high-frequency fluctuations. This paper proposes EXFormer, a novel Transformer-based architecture specifically designed for forecasting the daily exchange rate returns. We introduce a multi-scale trend-aware self-attention mechanism that employs parallel convolutional branches with differing receptive fields to align observations on the basis of local slopes, preserving long-range dependencies while remaining sensitive to regime shifts. A dynamic variable selector assigns time-varying importance weights to 28 exogenous covariates related to exchange rate returns, providing pre-hoc interpretability. An embedded squeeze-and-excitation block recalibrates channel responses to emphasize informative features and depress noise in the forecasting. Using daily EUR/USD, USD/JPY, and GBP/USD returns, we conduct out-of-sample evaluations across five different sliding windows. The model consistently outperforms the random walk benchmark, improving directional accuracy by a statistically significant margin of 8.5-22.8%. Nearly one year of trading backtests shows that these statistical gains translate into economically meaningful performance, obtaining cumulative net returns of 7%, 19%, and 9% with Sharpe ratios exceeding 1.8 after transaction costs. The robustness checks further confirm the model’s superiority under high-volatility and bear-market regimes. EXFormer offers a practical, interpretable, and knowledge-driven tool into exchange rate dynamics for international investors, multinational firms, and policy institutions.

additional info: link

published/working paper: arXiv paper

presentation: will be added soon

the recording of the presentation: recording - 2025-11-24, Monday, 5.00pm-6.30pm, 61st research seminar, title: “ Machine Learning for Daily Return Direction Forecasting: Predicting Socio-Economic Development in Poland in 2020–2024 Using Satellite Imagery“

authors: Łukasz Janisiów, Piotr Wójcik

abstract:Access to up-to-date statistical data is crucial for understanding and responding to socio-economic trends. However, in many parts of the world, official statistics are often delayed, and in some regions, reliable data may be scarce or entirely unavailable. This makes it difficult for researchers, policymakers, and organizations to make informed and timely decisions. Traditionally, nighttime lights satellite imagery has been used as a proxy for economic activity, but this approach lacks precision. Recent advances in high-resolution satellite imagery, combined with increased computational power, offer new opportunities for near real-time socio-economic monitoring. Compared to traditional statistical data, high-resolution imagery provides two key advantages: it is available almost in real time, and predictions can be made for any area, even if it does not align with official administrative boundaries. In this interdisciplinary study, we bridge economics, machine learning, and remote sensing to predict socio-economic development in Poland between 2020 and 2024. We use two approaches for feature extraction from high-resolution satellite imagery, introduce a novel dataset designed to support transfer learning in computer vision, and develop an end-to-end pipeline for predicting regional socio-economic indicators. Our work demonstrates the potential of satellite-based methods to complement, and in some cases substitute, traditional data sources, enabling more timely and granular insights into socio-economic dynamics.

additional info: link

published/working paper: will be added soon

presentation: will be added soon

the recording of the presentation: will be added soon - 2025-11-03, Monday, 6.30pm-8.00pm, 60th research seminar, title: “ Machine Learning for Daily Return Direction Forecasting: A Comparative Study with Explainable AI Insights“

authors: Krzysztof Płachta, Robert Ślepaczuk

abstract:This study addresses two interrelated objectives. First, we conduct a comparative evaluation of six supervised learning models: Lasso, Random Forest, LightGBM, LSTM, and two feedforward neural networks, for forecasting the next-day direction of SPY returns. Using a long-horizon of 25 years, expanding-window backtesting framework, we generate strictly out-of-sample forecasts and assess model performance based on risk-adjusted metrics, with the Sortino ratio as the primary criterion. Second, to address the opacity of complex machine learning models, we apply a model-agnostic explainable AI approach to the best-performing model. This involves systematically removing individual features and predefined feature groups, followed by full retraining with hyperparameters optimization, to quantify each variable’s contribution to overall performance. The results were mixed. Lasso, LightGBM, and most notably Random Forest – which achieved a Sortino ratio of 0.61, over 30% higher than the benchmark, and exhibited a substantially lower maximum drawdown – outperformed the buy-and-hold strategy. On the other hand, contrary to expectations, all neural network-based models significantly underperformed. In the second part, feature importance analysis for the Random Forest model suggests that signals based on technical indicators, foreign exchange, and commodity prices consistently contributed to improved performance, while certain interest rate and equity index features were detrimental. These findings emphasize the importance of thoughtful model design and feature selection in the development of machine learning strategies for financial forecasting.

additional info: link

published/working paper: SSRN working paper

presentation: presentation

the recording of the presentation: recording - 2025-10-20, Monday, 6.30pm-8.00pm, 59th research seminar, title: “ Systematic Bagging Model for market risk – cross pattern learning framework for Value at Risk and Expected Shortfall estimation“

authors: Michał Woźniak, Robert Ślepaczuk, Marcin Chlebus

abstract:This research proposes a new framework, the Systematic Bagging Model (SBM), for estimating market risk through leveraging ensembling and cross-learning approaches. The SBM is designed to make possible the generation of stable and accurate forecasts for Value at Risk and Expected Shortfall by using deterministic learning sets from time series data with optimal pattern searching. Empirical validation with the LIGHT Benchmark shows the superiority of an SBM over state-of-the-art standalone models concerning forecasting quality in terms of adequacy, regulatory compliance, and capital effectiveness. This research unveils a strong potential for systematic bagging and cross-learning for improving market risk models, especially during periods of sudden increased volatility.

additional info: link

published/working paper: SSRN working paper

presentation: presentation

the recording of the presentation: recording - New date of seminar: 2025-05-26, Monday, 5.30pm-7.00pm, 58th research seminar, title: “ From Theory to Practice: Polish Equity Risk Factors and Their Implementation Costs“

authors: Juliusz Jabłecki

abstract:This paper investigates the performance and implementability of equity factor strategies – value, momentum, quality, and low volatility (defensive) – in the Polish stock market over the 2014–2024 period. The “academic” factors constructed as long-short portfolios are found to produce positive returns lowly (or negatively) correlated with the broad market. However, once transaction costs – including bid-ask spreads, commissions, and market impact – are incorporated, net factor returns deteriorate substantially, losing much of their appeal. The absence of a developed short-selling market in Poland further challenges the direct replication of traditional academic factor models. Despite these frictions, factor signals can still add value in a long-only framework, particularly when turnover constraints and liquidity filters are introduced. Backtests of factor-tilted portfolios demonstrate that smart beta-style implementations, especially those complemented by short positions in WIG20 index futures neutralizing market exposure, offer a viable alternative to pure long-short factor strategies.

additional info: poster

link to the meeting: link

published/working paper: working paper

presentation: presentation

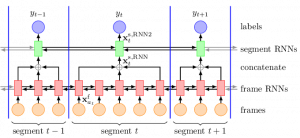

the recording of the presentation: recording - 2025-05-12, Monday, 6.30pm-8.00pm, 57th research seminar, title: “ Recurrent neural architectures for nonlinear volatility modeling“

authors: Josip Arneric and Mateusz Buczyński

abstract:We bring together two advances in volatility modeling – the Jordan Neural Network (Arnerić et al.) and GARCHNet (Buczyński & Chlebus) – and critically examine their relative strengths, limitations and potential synergies.

We first introduce the JNN(1,1,1) approach, a parsimonious Jordan‐type recurrent network designed as a semi‐parametric analog to GARCH(1,1). Applied to daily CROBEX returns, the JNN outperforms the standard GARCH(1,1) in out‐of‐sample conditional variance forecasts, preserving interpretability of key parameters while capturing time‐varying nonlinearity.

Next, we present GARCHNet, which embeds an LSTM architecture within a classical GARCH framework to capture richer nonlinear dynamics in conditional variance. By combining maximum‐likelihood‐based GARCH estimation with an LSTM module, the model flexibly accommodates normal, t and skewed‐t innovations. An empirical study on WIG20, SP 500 and FTSE 100 returns (2005–2021) demonstrates improved in‐sample fit and VaR performance, while suggesting further improvements for extending to alternative distributions and longer‐memory architectures.

A debate will follow to contrast these approaches and explore landscape for their integration.additional info: poster

link to the meeting: link

published/working paper: will be added soon

presentation: will be added soon

the recording of the presentation: will be added soon - 2025-04-28, Monday, 6.30pm-8.00pm, 56th research seminar, title: “ How to win world championships in econometrics“

authors: Jakub Bandurski, Eliza Hałatek, Adam Łaziński and Michał Kunstler

abstract:Econometric Game is an annual international competition in the field of econometrics and data analysis organized in the University of Amsterdam since 1999. Due to its prestige, the event is often called the world championships in econometrics. Four person groups of master and PhD students invited from best universities around the world compete for three days to solve a real economic task. In 2025 the team from the Faculty of Economic Sciences, University of Warsaw (Michał Kunstler, Jakub Bandurski, Eliza Hałatek and Adam Łaziński) won the game competing against 30 other universities (including Harvard, Cambridge and Oxford). The case topic this year focused on predicting power grid congestion in the German TenneT DE electricity network as part of the broader Energiewende initiative. Our team applied a combination of machine learning and econometric techniques, including CatBoost, LASSO regression, and ensemble modeling, to forecast both up and down congestion from 2020 to 2023. The solution featured rigorous data analysis, interpretability through explainable AI, and policy recommendations across short-, medium-, and long-term horizons to support more efficient energy redispatch and integration of renewable sources. We will present the path that led us to victory, including data that we used, deep-dive into algorithms applied and XAI techniques employed.

additional info: poster

published/working paper: will be added soon

presentation: will be added soon

the recording of the presentation: recording - 2025-04-14, Monday, 5.30pm-7.00pm, 55th research seminar, title: “ Factor Zoo (.zip)“

authors: Matthias X. Hanauer

abstract:The number of factors allegedly driving the cross-section of stock returns has grown steadily over time. We explore how much this ‘factor zoo’ can be compressed, focusing on explaining the available alpha rather than the covariance matrix of factor returns. Our findings indicate that about 15 factors are enough to span the entire factor zoo. This evidence suggests that many factors are redundant but also that merely using a handful of factors, as in common asset pricing models, is insufficient. While the selected factor styles remain persistent, the specific style representatives vary over time, underscoring the importance of continuous factor innovation.

additional info: poster

published/working paper: SSRN paper

presentation: will be added soon

the recording of the presentation: recording - 2025-03-17, Monday, 5.30pm-7.00pm, 54th research seminar, title: “ In the Beginning Was the Word: LLM-VaR and LLM-ES“

authors: Daniel Traian Pele

abstract:This study introduces LLM-VaR and LLM-ES, novel approaches utilizing general-purpose large language models (LLMs) for zero-shot forecasting of Value at Risk (VaR) and Expected Shortfall (ES). Using the LLMTime framework, these methods process financial time series data encoded as numerical strings, providing a flexible, assumption-free alternative to traditional risk estimation models such as GARCH and EWMA. Our empirical analysis reveals that LLMs perform effectively within a short-term historical context, particularly in highly volatile markets like cryptocurrencies. However, as the historical context lengthens, the accuracy of LLM-based methods diminishes, with conventional models proving superior for capturing long-term dependencies. These findings highlight the potential of LLMs as adaptable tools for risk assessment over recent historical windows, while underscoring the continued importance of traditional models for robust, long-term financial risk management.

additional info: poster

published/working paper: will be added soon

presentation: will be added soon

the recording of the presentation: will be added soon - 2025-03-03, Monday, 6.30pm-8.00pm, 53rd research seminar, title: “ Leveraging Convexity: Enhancing Global Equity Expected Returns with Trend-Following and Tail Risk Hedging Overlays “

authors: Bruno Schwalbach

abstract:This thesis demonstrates that overlaying a combination of trend-following and tail risk hedging strategies onto a global equity portfolio significantly enhances both historical risk-adjusted and absolute returns. Tail risk hedging mitigates equity risk most effectively during sudden market crashes, while trend-following notably supports equity during slower bear markets. These strategies are complementary in that the combination is demonstrated to mitigate severe drawdowns which occur during crises that have manifested both rapidly and gradually. In addition, the application of a trend-following strategy has generated positive returns on average during equity bull markets while remaining uncorrelated under normal conditions. Employing a portable alpha framework, the beta and alpha components of the Combination Overlay portfolio are separated. The performance of a 100% global equity portfolio is compared with a portfolio that embodies the Combination Overlay portfolio, which maintains the same 100% allocation to global equity (representing beta) and overlays it with trend-following and tail risk hedging strategies (representing alpha). The resulting portfolio returns remain largely driven by global equity performance but exhibit a large, positive, and statistically significant alpha of 0.38% per month after controlling for traditional equity factors, global government bond, and commodity excess returns. This alpha stems from a combination of an uncorrelated risk premium earned from the trend-following overlay and a reduction in variance drag due to the superior tail risk characteristics of the Combination Overlay portfolio, which leads to an improved compounding return profile relative to global equity.

additional info: poster

published/working paper: will be added soon

presentation: will be added soon

the recording of the presentation: recording - 2025-02-03, Monday, 6.30pm-8.00pm, 52th research seminar, title: “ Rebalance Timing Luck: Unveiling the Hidden Hand in Portfolio Returns “

authors: Corey Hoffstein

abstract:How much of your portfolio’s performance hinges on pure chance? Rebalance timing luck—an often-overlooked driver of investment outcomes—can significantly alter the trajectory of your strategy, sometimes in ways that defy expectations. This presentation dives into the mechanics and implications of rebalance timing, uncovering how periodic portfolio adjustments interact with market randomness to create significant variability in returns. Drawing insights from leading academic research and real-world case studies (including strategic asset allocation, factor portfolios, and option-based strategies), we’ll explore strategies to mitigate timing luck and control this hidden force.

additional info: poster

published/working paper: SSRN paper

presentation: presentation

the recording of the presentation: recording

- 2026-02-09, Monday, 7.00pm-8.00pm, 65th research seminar, title: “Carry, Convexity and Reliability – Navigating Tail Risk Hedging Dilemmas”

-

- 2025-01-27, Monday, 6.30pm-8.00pm, 51th research seminar, title: ” <strong=””> Informer in Algorithmic Investment Strategies on High Frequency Bitcoin Data”</strong=””>

authors: Filip Stefaniuk, Robert Ślepaczuk

abstract:The paper investigates the usage of Informer architecture for building automated trading strategies for high frequency Bitcoin data. Two strategies using Informer models with different loss functions, Quantile loss and Generalized Mean Absolute Directional Loss (GMADL), are proposed and evaluated against the Buy and Hold benchmark and two benchmark strategies based on technical indicators. The evaluation is conducted using data of various frequencies: 5 minute, 15 minute, and 30 minute intervals, over the 6 different periods. Although the Informer-based model with Quantile loss did not manage to outperform the benchmark, the model that uses novel GMADL loss function turned out to be benefiting from higher frequency data and beat all the other strategies on most of the testing periods. The primary contribution of this study is the application and assessment of the Quantile and GMADL loss functions with the Informer model to forecast future returns, subsequently using these forecasts to develop automated trading strategies. The research provides evidence that employing an Informer model trained with the GMADL loss function can result in superior trading outcomes compared to the buy-and-hold approach.

additional info: poster

published/working paper: SSRN paper

presentation: presentation

the recording of the presentation: recording

- 2025-01-27, Monday, 6.30pm-8.00pm, 51th research seminar, title: ” <strong=””> Informer in Algorithmic Investment Strategies on High Frequency Bitcoin Data”</strong=””>

-

- 2025-01-20, Monday, 5.30pm-7.00pm, 50th research seminar, title: “ Snapshots of Stories: Utilising Transformer Networks for Short Video Selection from Long-form Content “

authors: Jakub Wujec, Jakub Żmujdzin, Marcin Chlebus, Piotr Wójcik

abstract:We propose an automated method for detecting highlights in long-form videos by leveraging user engagement data from YouTube’s ”Most Replayed” feature. Focusing on sports and comedy videos, we adapt the Unified Multimodal Transformer (UMT) framework to evaluate the effectiveness of category-specific versus mixed-category models and different labeling strategies. Our experiments demonstrate that algorithms can accurately identify highlights based on user feedback. We find that labeling strategy and content type affect highlight detection effectiveness. Specifically, in our experiments, percentile-based labeling was more effective with user engagement data, when compared to z-score method. We observed that category-specific models performed better on comedy videos, while mixed-category models showed improved performance on sports videos, suggesting that the optimal modeling approach may vary depending on the content type.

additional info: poster

published/working paper: will be added soon

presentation: will be added soon

the recording of the presentation: will be added soon - 2024-12-02, Monday, 6.30pm-8.00pm, 49th research seminar, title: “ Can Artificial Intelligence Trade The Stock Market? “

authors: Jędrzej Maskiewicz, Paweł Sakowski

additional info: poster

published/working paper: will be added soon

presentation: presentation

the recording of the presentation: recording - 2024-11-18, Monday, 6.30pm-8.00pm, 48th research seminar, title: “ Conditioning cooperation with property rights in tragedy of the commons setting “

authors: Jakub Bandurski, Piotr Wójcik

additional info: poster

published/working paper: …

presentation: …

the recording of the presentation: recording

- 2025-01-20, Monday, 5.30pm-7.00pm, 50th research seminar, title: “ Snapshots of Stories: Utilising Transformer Networks for Short Video Selection from Long-form Content “

-

- 2024-11-04, Monday, 6.30pm-8.00pm, 47th research seminar, title: ” <strong=””> In Pursuit of Trend-Following Beta: The Promise and Pitfalls of Replication”</strong=””>

authors: Steven Braun, Corey Hoffstein, Juliusz Jabłecki

additional info: poster

published/working paper: SSRN paper

presentation: presentation

the recording of the presentation: recording - 2024-10-14, Monday, 6.30pm-8.00pm, 46th research seminar, title: “ Nighttime Lights as a Proxy for Economic Development on a Local Level – The Case of the US “

authors: Patrick Sliz, Piotr Wójcik

additional info: poster

published/working paper: will be added soon

presentation: will be added soon

the recording of the presentation: recording

- 2024-11-04, Monday, 6.30pm-8.00pm, 47th research seminar, title: ” <strong=””> In Pursuit of Trend-Following Beta: The Promise and Pitfalls of Replication”</strong=””>

-

- 2024-10-07, Monday, 6.40pm-8.00pm, 45th research seminar, title: “ Statistical arbitrage in multi-pair trading strategy based on graph clustering algorithms in US equities market “

authors: Adam Korniejczuk, Robert Ślepaczuk

additional info: poster

published/working paper: SSRN paper

published/working paper: arXiv paper

presentation: presentation

the recording of the presentation: recording

- 2024-10-07, Monday, 6.40pm-8.00pm, 45th research seminar, title: “ Statistical arbitrage in multi-pair trading strategy based on graph clustering algorithms in US equities market “

-

- 2024-04-08, Monday, 6.30pm-7.45pm, 44th research seminar, title: “ Uncovering the Asymmetric Information Content of High-Frequency Options “

authors: Mattia Bevilacqua

additional info: poster

published/working paper: paper

presentation: will be added soon

the recording of the presentation: recording

- 2024-04-08, Monday, 6.30pm-7.45pm, 44th research seminar, title: “ Uncovering the Asymmetric Information Content of High-Frequency Options “

-

- 2024-03-25, Monday, 4.45pm-6.15pm, 43rd research seminar, title: “ Analyzing Bitcoin Movements through Artificial Intelligence Evaluation of Facebook Sentiments “

authors: Daniel Traian Pele

additional info: poster

published paper: will be added soon

presentation: will be added soon

the recording of the presentation:

- 2024-03-25, Monday, 4.45pm-6.15pm, 43rd research seminar, title: “ Analyzing Bitcoin Movements through Artificial Intelligence Evaluation of Facebook Sentiments “

-

- 2024-03-04, Monday, 6.30pm-7.45pm, 42nd research seminar, title: “ Supervised Autoencoder MLP for Financial Time Series Forecasting “

authors: Bartosz Bieganowski, Robert Ślepaczuk

additional info: poster

published paper: paper

presentation: presentation

the recording of the presentation: recording

- 2024-03-04, Monday, 6.30pm-7.45pm, 42nd research seminar, title: “ Supervised Autoencoder MLP for Financial Time Series Forecasting “

-

- 2024-02-05, Monday, 5.45pm-7.00pm, 41st research seminar, title: ” On track to a green future: new insights on the impact of train transport on Warsaw suburban real estate market ”

authors: Paweł Sieczak, Piotr Wójcik

additional info: poster

published paper: will be added soon

presentation: presentation

the recording of the presentation: recording

- 2024-02-05, Monday, 5.45pm-7.00pm, 41st research seminar, title: ” On track to a green future: new insights on the impact of train transport on Warsaw suburban real estate market ”

-

- 2023-12-04, Monday, 6.30pm-8.00pm, 40th research seminar, title: “ Low-Volatility Equity Strategies and Interest Rates: A Bittersweet Perspective “

authors: Juliusz Jabłecki

additional info: poster

published paper: will be added soon

presentation: will be added soon

the recording of the presentation: will be added soon

- 2023-12-04, Monday, 6.30pm-8.00pm, 40th research seminar, title: “ Low-Volatility Equity Strategies and Interest Rates: A Bittersweet Perspective “

-

- 2023-11-27, Monday, 5.45pm-7.15pm, 39th research seminar, title: “ Beyond Yelp – predicting restaurant closures based on Google Maps data “

authors: Tomasz Starakiewicz and Piotr Wójcik

additional info: poster

published paper: will be added soon

presentation: will be added soon

the recording of the presentation: recording

- 2023-11-27, Monday, 5.45pm-7.15pm, 39th research seminar, title: “ Beyond Yelp – predicting restaurant closures based on Google Maps data “

-

- 2023-11-13, Monday, 6.30pm-8.00pm, 38th research seminar, title: “ Explaining and Forecasting Abnormal Returns and Volume by Investor Sentiment Indicators “

authors: Szymon Lis, Paweł Sakowski, Robert Ślepaczuk

additional info: poster

published paper: will be added soon

presentation: will be added soon

the recording of the presentation: will be added soon

- 2023-11-13, Monday, 6.30pm-8.00pm, 38th research seminar, title: “ Explaining and Forecasting Abnormal Returns and Volume by Investor Sentiment Indicators “

-

- 2023-10-23, Monday, 5.45pm-7.15pm, 37th research seminar, title: “ How much is my harm worth? Predicting the amount of compensation for harm awarded by the Polish courts “

authors: Maciej Świtała

additional info: poster

published paper: will be added soon

presentation: will be added soon

the recording of the presentation: recording

- 2023-10-23, Monday, 5.45pm-7.15pm, 37th research seminar, title: “ How much is my harm worth? Predicting the amount of compensation for harm awarded by the Polish courts “

-

- 2023-10-09, Monday, 6.30pm-8.00pm, 36th research seminar, title: “ Comprehensive Comparison of Quantitative Finance Models for Hedging of Options Portfolio“

authors: Maciej Wysocki, Robert Ślepaczuk

additional info: poster

published paper: will be added soon

presentation: will be added soon

the recording of the presentation: recording

- 2023-10-09, Monday, 6.30pm-8.00pm, 36th research seminar, title: “ Comprehensive Comparison of Quantitative Finance Models for Hedging of Options Portfolio“

-

- 2023-06-12, Monday, 6.30pm-8.00pm, 35th research seminar,title: “The Credit Card Debt Puzzle and Noncognitive Ability“

author: Hwan-Sik Choi

additional info: poster

published paper: working paper

presentation: will be added soon

the recording of the presentation: will be added soon

- 2023-06-12, Monday, 6.30pm-8.00pm, 35th research seminar,title: “The Credit Card Debt Puzzle and Noncognitive Ability“

-

- 2023-04-24, Monday, 5.00pm-6.30pm, 33rd research seminar,title: “Proof-of-work versus proof-of-stake coins as possible hedges against green and dirty energy“

authors: Barbara Będowska-Sójka, Agata Kliber

additional info: poster

working paper: will be added soon

presentation: will be added soon

the recording of the presentation: recording

- 2023-04-24, Monday, 5.00pm-6.30pm, 33rd research seminar,title: “Proof-of-work versus proof-of-stake coins as possible hedges against green and dirty energy“

-

- 2023-04-03, Monday, 6.30pm-8.00pm, 32nd research seminar,title: “The Systemic Risk Approach Based on Implied and Realized Volatility“

authors: Paweł Sakowski, Rafał Sieradzki, Robert Ślepaczuk

additional info: poster

working paper: working paper

presentation: will be added soon

the recording of the presentation: recording

- 2023-04-03, Monday, 6.30pm-8.00pm, 32nd research seminar,title: “The Systemic Risk Approach Based on Implied and Realized Volatility“

-

- 2023-03-06, Monday, 6.30pm-8.00pm, 31st research seminar,title: “On Randomization of Affine Diffusion Processes with Application to Pricing of Options on VIX and S&P 500“

authors: Lech A. Grzelak

additional info: poster

working paper: working paper

presentation: presentation

the recording of the presentation: recording

- 2023-03-06, Monday, 6.30pm-8.00pm, 31st research seminar,title: “On Randomization of Affine Diffusion Processes with Application to Pricing of Options on VIX and S&P 500“

-

- 2023-02-27, Monday, 5.00pm-6.30pm, 30th research seminar,title: “Deep learning–based automated measurements of the scrotal circumference of Norwegian Red bulls from 3D images“

authors: Joanna Bremer, Michał Maj

additional info: poster

published paper: will be added soon

presentation: will be added soon

the recording of the presentation: will be added soon

- 2023-02-27, Monday, 5.00pm-6.30pm, 30th research seminar,title: “Deep learning–based automated measurements of the scrotal circumference of Norwegian Red bulls from 3D images“

-

- 2023-02-06, Monday, 6.30pm-8.00pm, 29th research seminar,title: “The Properties of Alpha Risk Parity Portfolios“

authors: Jérôme Gava, Julien Turc

additional info: poster

published paper: published paper

presentation: will be added soon

the recording of the presentation: will be added soon

- 2023-02-06, Monday, 6.30pm-8.00pm, 29th research seminar,title: “The Properties of Alpha Risk Parity Portfolios“

-

- 2023-01-23, Monday, 3.00pm-6.00pm, 28th research seminar,

additional info: poster

3.00pm

title: “Crypto volatility forecasting: ML vs GARCH“

authors: Prof. Dr. Wolfgang Härdle

the recording of the presentation: recording

4:15pm-4:30pm

coffee break

4:30pm

title: “Cross-exchange Crypto Risk: A High-frequency Dynamic Network Perspective“

authors: Yifu Wang

the recording of the presentation: recording

5:10pm

title: “Quantinar – The 2P2 Platform for Knowledge Sharing“

authors: Raul Bag

the recording of the presentation: recording

- 2023-01-23, Monday, 3.00pm-6.00pm, 28th research seminar,

- 2023-01-16, Monday, 6.30pm-8.00pm, 27th research seminar,title: “Performance and Flow of SRI Mutual Funds and Investors Sophistication“

authors: Olga Klinkowska, Yuan Zhao

additional info: poster

working paper: working paper

presentation: will be added soon

the recording of the presentation: recording

- 2022-12-19, Monday, 5.00pm-6.30pm, 26th research seminar,title: “Absorption capacity of regions in terms of supporting entrepreneurship under the EU

Cohesion Policy. New evidence“

authors: Marcin Wajda, Piotr Wójcik

additional info: poster

working paper: will be added soon

presentation: will be added soon

the recording of the presentation: will be added soon

- 2022-12-05, Monday, 6.30pm-8.00pm, 25th research seminar,title: “Daily and intraday application of various architectures of the LSTM model in algorithmic investment strategies on Bitcoin and the S&P 500 Index “

authors: Katarzyna Kryńska, Robert Ślepaczuk

additional info: poster

working paper: working paper

presentation: presentation

the recording of the presentation: recording

- 2022-11-21, Monday, 5.00pm-6.30pm, 24th research seminar,title: “Is attention all you need for intraday Forex trading?“

authors: Przemysław Grądzki, Piotr Wójcik

additional info: poster

working paper: will be added soon

presentation: presentation

the recording of the presentation: recording

- 2022-11-07, Monday, 6.30pm-8.00pm, 23rd research seminar,title: “A comparison of LSTM and GRU architectures with novel walk-forward approach to algorithmic investment strategy“

authors: Illia Baranochnikov, Robert Ślepaczuk

additional info: poster

working paper: working paper

presentation: presentation

the recording of the presentation: recording

- 2022-10-24, Monday, 5.00pm-6.30pm, 22nd research seminar,title: “What makes Punks worthy? Valuation of Non-Fungible Tokens based on the CryptoPunks collectio“

authors: Ewelina Plachimowicz, Piotr Wójcik

additional info: poster

working paper: will be added soon

presentation: will be added soon

the recording of the presentation: recording

- 2022-10-10, Monday, 6.30pm-8.00pm,title: “Investment Portfolio Optimization Based on Modern Portfolio Theory and Deep Learning Models“

authors: Maciej Wysocki, Paweł Sakowski

additional info: poster

working paper: working paper

presentation: presentation

the recording of the presentation: recording

- 2022-06-20, Monday, 5.00pm-6.00pm,title: “Satellite imaginary for social data science“

authors: Xaquín S. Perez-Sindin, Piotr Wójcik

additional info: poster

- 2022-05-09, Monday, 5.00pm-6.00pm,title: “The modeling of earnings per share of Polish companies for post-financial crisis period using random walk and ARIMA models“

authors: Wojciech Kuryłek

additional info: poster

working paper: will be added soon

presentation: presentation

the recording of the presentation: will be added soon

- 2022-04-11, Monday, 5.00pm-6.00pm,title: “Application of Machine Learning in Algorithmic Investment Strategies on Global Stock

markets“

authors: Jan Grudniewicz, Robert Ślepaczuk

additional info: poster

working paper: working paper

presentation: presentation

the recording of the presentation: recording

- 2022-03-21, Monday, 5.00pm-6.00pm,title: “LSTM in Algorithmic Investment Strategies on BTC and S&P500 index“

authors: Jakub Michańków, Paweł Sakowski, Robert Ślepaczuk

additional info: poster

final publication: paper

presentation: presentation

the recording of the presentation: recording

- 2022-02-28, Monday, 5.00pm-6.00pm,title: “Textual Content and Academic Selectivness. A Case of Economic Journals“

authors: Paweł Baranowski, Szymon Wójcik

additional info: poster

working paper: will be added soon

presentation: presentation

the recording of the presentation: recording

- 2022-01-17, Monday, 3.00pm-4.30pm,title: “Forecasting of the Day-Ahead Energy Prices“

authors: Maciej Przybyła, Piotr Wójcik

additional info: poster

working paper: will be added soon

presentation: presentation

the recording of the presentation: recording

- 2021-12-13, Monday, 3.00pm-4.30pm,title: “Effective Local Volatility Model – with Application to Pricing American Basket Options“

authors: Juliusz Jabłecki

additional info: poster

working paper: will be added soon

presentation: presentation

the recording of the presentation: recording

- 2021-11-22, Monday, 4.45pm-6.30pm,

title: “Analysis of the Effectiveness of the Polish Judicial System Using Topic Modelling Tools“

authors: Maciej Świtała (PhD student at WNE UW)

additional info: poster

working paper: will be added soon

presentation: presentation

the recording of the presentation: recording

- 2021-10-18, Monday, 3.00pm-4.30pm,

title: “Robust Optimisation Procedure in Algorithmic Investment Strategies“

authors: Sergio Castellano Gomez and Robert Ślepaczuk

additional info: poster

working paper: https://www.wne.uw.edu.pl/files/4916/3768/6325/WNE_WP375.pdf

presentation: presentation

the recording of the presentation: recording

- 2021-06-21, Monday, 5.00pm-6.30pm,

title: “Enhanced Index Replication Based on Smart Beta and the Analysis of Distribution Moments“

authors: Kamil Korzeń and Robert Ślepaczuk

additional info: poster

working paper: https://www.wne.uw.edu.pl/files/6916/2748/4276/WNE_WP366.pdf

presentation: presentation

the recording of the presentation: recording

- 2021-05-17, Monday, 5.00pm-6.30pm,

title: “Identification of Scams in Initial Coin Offerings with Machine Learning“

authors: Bedil Karimov and Piotr Wójcik

additional info: poster

working paper: will be added soon

presentation: will be added soon

the recording of the presentation is available here: will be added soon

- 2021-04-19, Monday, 5.00pm-6.30pm,

title: “XAI Tools as a Part of the Best Practices in Model Selection for Business Decision Modelling. Example of marketing campaign success forecasting“

authors: Marcin Chlebus

additional info: poster

working paper: will be added soon

presentation: will be added soon

the recording of the presentation is available here: will be added soon

- 2021-03-22, Monday, 5.00pm-6.30pm,

title: “The impact of the content of Federal Open Market Committee post-meeting statements on financial markets – text mining approach“

authors: Ewelina Osowska, Piotr Wójcik

additional info: poster

working paper: https://www.wne.uw.edu.pl/files/7216/0210/4545/WNE_WP339.pdf

presentation: will be added soon

the recording of the presentation is available here: recording

- 2021-02-22, Monday, 5.00pm-6.30pm,

title: “Investment Opportunities on the Cryptocurrency Market within the Markowitz Framework“

authors: Paweł Sakowski, Anna Turovtseva

additional info: poster

working paper: https://www.wne.uw.edu.pl/files/5016/1041/4810/WNE_WP347.pdf

application: application

presentation: presentation

the recording of the presentation is available here: recording

- 2021-01-18, Monday, 5.00pm-6.30pm,

title: “What Factors Determine Unequal Suburbanisation? New Evidence from Warsaw, Poland“

authors: Honorata Bogusz, Szymon Winnicki, Piotr Wójcik

additional info: poster

working paper: https://www.wne.uw.edu.pl/files/1216/0224/3666/WNE_WP340.pdf

the recording of the presentation is available here: https://lnkd.in/g7cV7iX

- 2020-12-14, Monday, 5.00pm-6.30pm,

title: “Artificial Neural Networks Performance in WIG20 Index Options Pricing”

authors: Maciej Wysocki, Robert Ślepaczuk

additional info: poster

working paper: https://www.wne.uw.edu.pl/files/2615/9372/4397/WNE_WP325.pdf

presentation: presentation

- 2020-11-16, Monday, 5.00pm-6.30pm,

title: “Size Does Matter. A Study of the Required Window Size for Optimal Quality Market Risk Models“

authors: Mateusz Buczyński, Marcin Chlebus

additional info: poster

working paper: https://www.wne.uw.edu.pl/files/9215/9039/7402/WNE_WP315.pdf

the recording of the presentation is available here: https://lnkd.in/eiMwF3C

- 2020-01-21, Monday, 4.45pm-5.45pm,

title: ” We Just Explained the Factors of Growth with Machine Learning!“

authors: Piotr Wójcik, Bartłomiej Wieczorek

additional info: poster

where: Faculty of Economic Sciences, University of Warsaw, Warsaw, ul. Długa 44/50

room: B002

working paper: https://www.wne.uw.edu.pl/files/5216/0322/9893/WNE_WP344.pdf

- 2019-12-17, Monday, 4.45pm-5.45pm,

title: “Recurrent Neural Networks vs. Classical Methods in Investment Strategies “

authors: Mateusz Kijewski, Robert Ślepaczuk

additional info: poster

where: Faculty of Economic Sciences, University of Warsaw, Warsaw, ul. Długa 44/50

room: B002

presentation: presentation

working paper: https://www.wne.uw.edu.pl/files/6215/9765/7140/WNE_WP333.pdf

- 2019-11-19, Monday, 4.45pm-5.45pm,

title: “Predicting well-being based on features visible from space – the case of Warsaw!”

authors: Piotr Wójcik, Krystian Andruszek

additional info: poster

where: Faculty of Economic Sciences, University of Warsaw, Warsaw, ul. Długa 44/50

room: B002

working paper: https://www.wne.uw.edu.pl/files/1416/0322/8088/WNE_WP343.pdf - 2019-10-15, Monday, 4.45pm-5.45pm,

title: “Diversification with cryptocurrencies? OMG, really?! “

authors: Paweł Sakowski, Przemysław Ryś

additional info: poster

where: Faculty of Economic Sciences, University of Warsaw, Warsaw, ul. Długa 44/50

room: B002