We invite you to the first seminar inaugurating the monthly series of meetings organised jointly by QFRG (Quantitative Finance Research Group) and DSLab (Data Science Lab). The first meeting will be devoted to the presentation entitled Diversification with cryptocurrencies? OMG, really? Dr Paweł Sakowski and Przemysław Ryś will present interactive cloud-deployed Shiny application implementing Markowitz (1952) model for equity and crypto markets.

QFRG http://qfrg.wne.uw.edu.pl/ is a place where research is conducted and experiences are exchanged between people engaged in examining occurrences in the world of investment from the perspective of both theory and practice, on the verge of science and business.

The activities of DSLab http://dslab.wne.uw.edu.pl/ is focused mainly on academic projects devoted to deepening of the knowledge of DSLab team, sharing it with other people interested in Data Science issues and preparing scientific and didactic research.

The first meeting will take place on October 15, 2019 (Tuesday) at 16.45 in room B002 at the Faculty of Economic Sciences of the University of

The seminar will be divided into three parts:

[4:45 pm – 5:00 pm] The presentation of QFRG activity by dr Robert Ślepaczuk,

[5:00 pm – 5:15 pm] The presentation of DSLab activity by dr Piotr Wójcik,

[5:15 pm – 6:15 pm] Diversification with cryptocurrencies? OMG, really? by dr Paweł Sakowski and Przemysław Ryś,

Abstract:

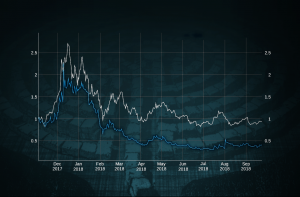

Our interactive cloud-deployed Shiny application implements Markowitz (1952) model for equity and crypto markets. We can analyse not only equity lines and performance measures for our strategies and benchmark portfolios, but also perform interactive sensitivity analysis with respect to the length of historical window, the frequency of portfolio rebalancing and the degree of financial leverage. The app serves to illustrate the potential of portfolio risk diversification offered by crypto markets. Presentation of our application will be accompanied with a gentle introduction to Modern Portfolio Analysis – it’s not a rocket science, so everyone is invited!