The Quantitative Finance Research Group (QFRG) was established in 2010 at the Faculty of Economic Sciences, University of Warsaw. The QFRG is aimed to be a leading center for academic research into quantitative finance and encompasses the largest concentration of research excellence in quantitative finance in Poland. The QFRG brings together a team of senior academics, young researchers and students to undertake cutting edge theoretical and empirical research on quantitative finance.

The QFRG is a place for true passionates who are interested in practical implementation of financial theories and tools and developing new ones during the research process. The QFRG has also developed strong links with the community, in particular investment banks, stock exchanges, other universities, and attracts support from a large number of corporations.

Areas of interest:

- Asset Allocation and Management

- Algorithmic and HFT Trading

- Model Development and Optimization

- Risk Management

- Financial Econometrics

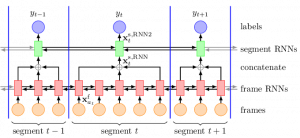

- Machine Learning (genetic programming, neural networks, reinforcement learning)

QFRG Mission:

- To be a world-class center in quantitative finance, bringing together a strong research team of specialists in quantitative finance and financial econometrics.

- To promote excellence in the science and practice of quantitative finance through research, training and consultancy.

QFRG goals:

- to develop theoretical and empirical research in quantitative finance, especially about the process of creating and implementing investment strategies,

- to exchange experiences and propagating knowledge (via meeting, seminars, conferences) about the newest achievements in quantitative finance amongst experts working in both the educational as well as the financial sector

- to review investment strategies available on the market used by financial institutions,

- to complete research projects using the newest achievements of quantitative finance and financial econometrics in practice,

- to collect financial data necessary for future research,

- to establishing lasting cooperation with financial institutions, which are assumed to be one of the main beneficiaries of project empirical results

- to publish the results results in scientific journals and books

We want to realize these goals through an interdisciplinary approach to the topic of creating an investment policy via various types of asset management institutions. We believe that this approach allows to combine knowledge from three basic fields: finance, mathematics and computer science, which is necessary for any advanced approach to create succesful investment strategies.