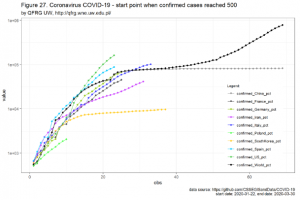

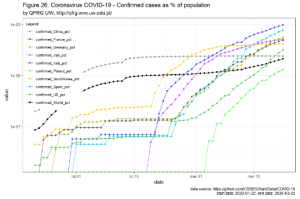

Increasing panic in societies helps to control them and influence their decisions but at the same time it limits their rational behaviors and stop them from the most appropriate actions at the correct time, so … should we present well-processed data, e.g. properly showing the dynamics of the development of the epidemic in each country or should we focus only on absolute numbers which will naturally grow to the very end of the epidemic? – the question is of course rhetorical.

… despite the fact that the level of panic recently observed on financial markets is not fully justified, at the same time the prolonged unprecedented governmental activities related to closing borders, isolating economies, the inability to conduct business in a normal form and, as a consequence, a complete break in the supply chain can have very negative and unpredictable economic effects. What is worse, the subsequent consequences of these activities, e.g. related to the bankruptcy of even entire sectors of the economy, may have in practice much more severe consequences for the societies of individual countries through significant and permanent destabilization of entire economies, and then the current exaggerated reaction of exchanges, unfortunately post factum, will show fully adequate!

The next portion of QFRG WNE UW Coronavirus report focusing on single countries and aggregated level for the most infected countries can be found here.