We invite everyone to the next seminar of the QFRG and the DSLab!

It will take place on Tuesday 17th December 2019 at 16.45 in room B002 at the Faculty of Economic Sciences of the University of Warsaw (ul. Długa 44/50).

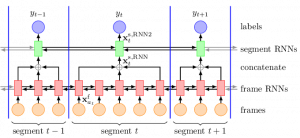

Mateusz Kijewski and dr Robert Ślepaczuk will discuss applications of Recurrent Neural Networks in investment strategies and compare them with classical methods for generating investments signals. The meeting will be held in English.

The presentation can be found under the following link.

Please confirm your participation before 16th December by sending short message to qfrg@wne.uw.edu.pl.