The Department of Quantitative Finance at the Faculty of Economic Sciences University of Warsaw and the Quantitative Finance Research Group invite everyone interested to attend the conference:

EQUITY RISK PREMIUM DETERMINANTS FOR EMERGING AND DEVELOPED MARKETS

2016-11-24, 16:00

University of Warsaw

Faculty of Economic Sciences Room B

Programme of the conference:

| 16.00-16.15 | Reception desk and coffee | |

| 16.15-16.25 | dr hab. prof. UW Ryszard Kokoszczyński | Conference opening |

| 16.25-16.55 | dr Juliusz Jabłecki | The rise and fall of synthetic CDO market: lessons learned |

| 16.55-17.25 | Mateusz Wywiał | Applying exogenous variables and regime switching to multifactor models on world equity indices |

| 17.25-17.55 | dr Paweł Sakowski | Do multifactor models produce robust results? Econometric and diagnostic issues in equity risk premia study |

| 17.55-18.15 | Cofee break | |

| 18.15-18.45 | dr Robert Ślepaczuk | Can we invest on the basis of equity risk premia? |

| 18.45-19.15 | dr Marcin Chlebus | EWS-GARCH: New Regime Switching Approach to Forecast Value-at-Risk |

| 19.15-19.45 | dr Piotr Wójcik | Volatility as a new class of assets? The advantages of using volatility index futures in investment strategies |

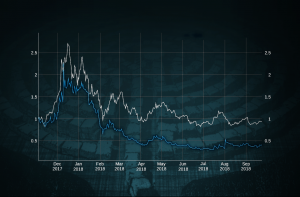

| 19.45-20.05 | Mateusz Wywiał | Bitcoin As a New Asset Class |

| 20.05-20.15 | dr hab. prof. UW Ryszard Kokoszczyński | Conference closing |

If you are interested in participation, please register by sending email at qfrg@wne.uw.edu.pl with your name and professional/educational occupation.

If you want to book seats for other employees/friends of your company/university please send us additional information.